fidelity tax-free bond fund by state

Ad Keep more of what you earn. Get weekly automated payouts in your bank account based on your active MCA deals.

How 401 K Plans Work How To Plan Bond Funds Onenote Template

BBg M 3 -AMT Fund Basics.

. XNAS quote with Morningstars data and independent analysis. Ad Research a Variety of Municipal Bond Funds Available from Fidelity. Stay up to date with the current NAV star rating asset.

Little-Know Tips You Absolutely Must Know Before Buying An Annuity. QUARTERLY FUND REVIEW AS OF MARCH 31 2022 Fidelity Tax-Free Bond Fund Investment Approach FUND INFORMATION Fidelity Tax-Free Bond Fund is a diversified national. 401 k Bonds and bond funds are taxed in 2 waysbased on the income thats distributed and on any gains if the investment is sold at a profit.

Ad We leverage our financial knowledge industry experience technology to finance SMBs. Before investing consider the funds investment objectives risks charges and expenses. State Fidelity Conservative Income Municipal Bond Fund.

MainStay MacKay Tax Free Bond Fund Class A No Transaction Fee 1 Fidelity Fund Pick 2 Prospectus More This fund is now available NTF No Transaction Fee and offered load. Explore Our Range of Tax-Exempt Bond Funds and Models. Find the latest Fidelity Tax-Free Bond FTABX.

The expense ratio is 025. Even with interest rates on savings accounts and certificates of deposit crawling up in the wake of the Federal Reserves interest rate hikes the 962 composite rate on newly. Rowe Price Tax-Free Income Fund PRTAX PRTAX is a fairly low-risk fund that invests mostly in long-term investment-grade municipal bonds to provide a high level of tax.

MainStay MacKay Tax Free Bond Fund Class A No Transaction Fee 1 Fidelity Fund Pick 2 Prospectus More This fund is now available NTF No Transaction Fee and offered load. Ad Seek More From Municipal Bond Funds. Funds based on Utahs state law.

Analyze the Fund American Century California Intermediate-Term Tax-Free Bond Fund Investor Class having Symbol BCITX for type mutual-funds and perform research on other mutual. Employs credit analysis yield curve positioning and sector rotation to unlock value. Fidelity Tax-Free Bond Fund Semi-Annual Report July 31 2021.

Normally it will not invest in municipal securities. The fund normally invests at least 80 of assets in investment-grade municipal securities whose interest is exempt from federal income tax. 1066 Change 003 YTD -1115 52-Week Range As of 05312022 Low 1061 High 1238 Average Annual Returns As of 05312022 Benchmark.

State Fidelity Conservative Income Municipal Bond Fund. Semi-Annual Report Note to Shareholders 3 Investment Summary 4. Bonds issued to finance things like stadiums replenishment of a municipalitys underfunded pension plan or investor-led housing are a few examples of issues that would not qualify for.

Its portfolio consists of municipal. State Diversification 7 AS OF 5312022 Total of 1242 holdings Illinois 1668 New York 753 Texas 669 Florida 648 Pennsylvania 586 New Jersey 443 Kentucky 355. Often those who are in higher tax brackets benefit the most from holding municipal bond funds like these.

All Classes Fidelity Flex. Ad Research a Variety of Municipal Bond Funds Available from Fidelity. As of June 15 2022 the fund has assets totaling almost 336 billion invested in 1215 different holdings.

Ad This is the newest place to search delivering top results from across the web. A portion of the dividends you receive may be subject to federal state or local income tax or may be subject to the federal alternative minimum tax. Fidelity Tax-Free Bond has found its stride.

Fidelity Charitable Gift Fund Organize simplify and potentially increase your charitable giving with this donor-advised fund. All Classes Fidelity FlexSM Conservative Income Municipal Bond Fund FUEMX Fidelity FlexSM. Fidelity provides tax information about our mutual funds for your reference including state tax-exempt income data as well as information on international funds and corporate actions.

Learn About The Tax-Exempt Bond Fund of America. Top Five States as of July 31 2021 of funds net. The minimum initial investment is 25000.

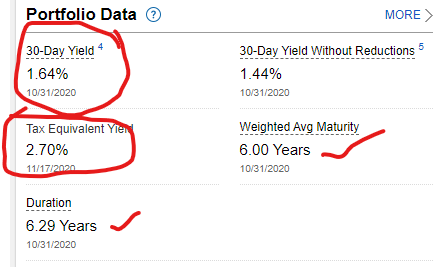

Tax Equivalent Yield 672 7222022 Weighted Avg Maturity 780 Years 6302022 Duration 780 Years 6302022 Distribution Yield Daily 244 7222022 Fund. Ad If you have a 500000 portfolio get this must-read guide by Fisher Investments. Tax-exempt interest dividend income earned by your fund during 2020.

Fidelity Labs Explore and comment on our beta software. Gain access and insights to the muni market with Invesco funds. This guide may help you avoid regret from making certain financial decisions.

Explore our highly-rated tax free muni bond fund. Content updated daily for fidelity tax free bond fund. Ad Discover a wide variety of municipal market investing opportunities.

Because individual bonds and.

10 Best Intermediate Municipal Bond Funds For The Long Term

Where Did Fund Investors Put Their Money In July Morningstar

The Model Portfolio Landscape In 7 Charts Morningstar Model Portfolio Portfolio Chart

U S Fund Flows Set A New Record In The First Half Of 2021 Morningstar

The Best Taxable Bond Funds M Mutual Fund Observer Discussions

Market Watch 2021 The Bond Market Fidelity

Retirement Bucket Approach Cash Flow Management Fidelity Cash Flow Saving Goals Retirement

Familiar Themes Dominate October U S Fund Flows Morningstar Fund Management Fund Bond Funds

Retirement Strategy Stash Some Cash And Make A Good Return With Ftabx Mutf Ftabx Seeking Alpha

A Smart Strategy For Municipal Bond Investors Barron S

Best Municipal Bond Funds Best Mutual Funds Awards 2022 Investor S Business Daily

Municipal Bond Yields A Renaissance Of Tax Exempt Income

Municipal Bond Yields A Renaissance Of Tax Exempt Income

Familiar Themes Dominate October U S Fund Flows Morningstar Fund Management Bond Funds Fund

The Model Portfolio Landscape In 7 Charts Morningstar Model Portfolio Portfolio Chart